Table of Contents

ToggleIntroduction

Let’s be honest — if you live in Phoenix or have been thinking about buying or selling here, the phrase Phoenix housing market correction probably grabs your attention instantly. Just a few years ago, homes were selling in days. Offers poured in. Prices jumped at breathtaking speed. It felt unstoppable. Now? The energy has shifted. Listings are sitting longer. Buyers are negotiating again. Price reductions are no longer rare. And everyone is asking the same thing: Is this the beginning of something bigger, or simply the market finding its balance? The Phoenix housing market correction isn’t just a statistic — it’s a story unfolding in real time. And if you’re part of this market, that story affects your money, your timing, and your future plans. Let’s unpack what’s really happening, why it matters, and how you can position yourself wisely in today’s changing landscape.

The Rise Before the Phoenix Housing Market Correction

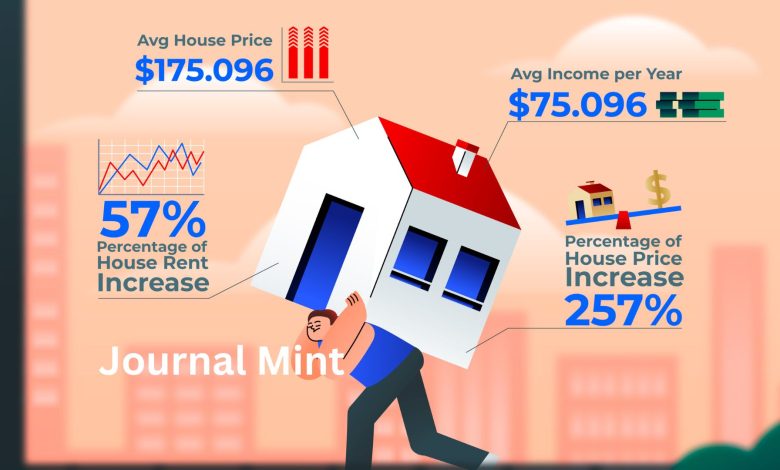

To understand the Phoenix housing market correction, we need to rewind. Between 2020 and 2022, Phoenix experienced one of the fastest home price increases in the nation. Remote work trends brought an influx of out-of-state buyers. Compared to coastal cities, homes in Arizona looked affordable. Investors moved quickly. Families relocated for lifestyle and sunshine. Builders struggled to keep up. Inventory shrank dramatically. Bidding wars became routine. Sellers held all the leverage. In many neighborhoods, homes appreciated by double digits year after year. Equity soared. But rapid growth at that speed rarely lasts forever. Markets, like seasons, change. The Phoenix housing market correction is not random — it’s the natural response to an overheated period.

What Exactly Is the Phoenix Housing Market Correction?

A housing market correction happens when prices pull back or stabilize after unsustainable growth. It’s important to emphasize: a correction is not a collapse. The Phoenix housing market correction reflects shifting supply and demand dynamics. Mortgage rates climbed sharply compared to the ultra-low levels of 2020 and 2021. Higher borrowing costs reduced purchasing power. At the same time, more homeowners decided to list their properties. The result? Increased inventory and softer demand. When buyers regain negotiating power, price growth slows — and sometimes reverses slightly. The Phoenix housing market correction is essentially the market recalibrating after a historic run-up.

Why the Phoenix Housing Market Correction Feels So Dramatic

The reason the Phoenix housing market correction feels intense is because the boom before it was intense. When appreciation is gradual, slowdowns feel mild. But when values spike rapidly, any pullback feels amplified. Some neighborhoods that saw aggressive investor activity are experiencing sharper adjustments. Luxury segments, which depend heavily on high-end buyer confidence, have also seen price flexibility. However, many mid-range homes in desirable areas remain competitive. The Phoenix housing market correction is not uniform. It varies by price point, location, and property condition.

Mortgage Rates and the Phoenix Housing Market Correction

Mortgage rates play a central role in the Phoenix housing market correction. When rates were historically low, affordability expanded. Buyers could stretch budgets further. As rates increased, monthly payments rose significantly even if prices stayed the same. That psychological shift matters. Buyers began calculating differently. Some paused. Others downsized expectations. The cooling demand triggered part of the Phoenix housing market correction. Even small rate changes can dramatically impact buyer behavior in a market as active as Phoenix.

Inventory Growth and Negotiation Power

During the boom, inventory was extremely tight. Sellers had control. Today, inventory levels have improved compared to the frenzy years. This doesn’t mean Phoenix is flooded with homes, but it does mean buyers have options again. And options create leverage. The Phoenix housing market correction has restored traditional negotiation dynamics. Buyers request inspections. Sellers offer concessions. Closing cost assistance and interest rate buy-downs are back on the table. The emotional urgency has eased, replaced by careful decision-making.

What the Phoenix Housing Market Correction Means for Buyers

If you’re a buyer, this shift can feel refreshing. You no longer need to waive contingencies or rush into decisions. The Phoenix housing market correction allows for thoughtful purchasing. You can compare properties, negotiate price adjustments, and even ask for repairs. That said, affordability still depends heavily on financing. Higher mortgage rates mean monthly payments remain a critical factor. The opportunity lies in reduced competition and price flexibility, not necessarily in rock-bottom pricing. Smart buyers focus on long-term value rather than short-term market timing.

What the Phoenix Housing Market Correction Means for Sellers

For sellers, the strategy has changed. The days of simply listing and waiting for multiple offers may be gone for now. Pricing accurately is crucial. Overpricing in a correcting market often leads to extended days on market and eventual reductions. The Phoenix housing market correction rewards realistic expectations. Homes that show well, are updated, and priced competitively continue to sell. Presentation matters more than ever. Professional photography, staging, and strategic pricing are essential in this environment.

Investors and Long-Term Outlook

Investors are analyzing the Phoenix housing market correction through a different lens. Short-term speculative plays have cooled. However, long-term fundamentals remain compelling. Phoenix continues to attract new residents and businesses. Rental demand remains steady in many areas. Investors who focus on cash flow rather than rapid appreciation may find opportunity during the Phoenix housing market correction. Market slowdowns often separate speculative investors from disciplined ones.

Is This a Crash? Let’s Address the Fear

Whenever the phrase Phoenix housing market correction appears in headlines, it often sparks fear, especially for those who remember the housing collapse during the Great Recession. But a true crash involves widespread foreclosures, distressed sales, and major job losses. The current Phoenix housing market correction does not show those signs. Lending standards are stronger, most homeowners have built solid equity, and regional employment remains stable. This shift appears to be driven by affordability and higher interest rates, not systemic financial instability.

Neighborhood Variations Within Phoenix

Not all areas are reacting the same way. Desirable communities with strong amenities, school districts, and accessibility continue to see stable demand. Investor-heavy pockets may show more noticeable price reductions. Luxury homes may take longer to sell due to smaller buyer pools. The Phoenix housing market correction is hyperlocal. Understanding neighborhood trends is more important now than during the boom. Broad headlines rarely capture street-level realities.

The Emotional Side of the Phoenix Housing Market Correction

Real estate is emotional. For homeowners who watched their property values climb rapidly, seeing stabilization or slight declines can feel unsettling. For buyers who felt priced out, the correction feels like relief. The Phoenix housing market correction creates a psychological reset. It reminds us that markets are cyclical. Fear and euphoria both fade. What remains are fundamentals: supply, demand, affordability, and long-term growth patterns.

What Could Happen Next?

Several factors will shape the future of the Phoenix housing market correction. Mortgage rate movements will significantly influence demand. Job growth and migration trends will impact household formation. New construction activity will affect inventory levels. If rates stabilize or decrease, buyer activity could strengthen again. If economic uncertainty rises, demand could soften further. The Phoenix housing market correction is not a fixed event — it’s a phase within a broader cycle.

FAQs About the Phoenix Housing Market Correction

Is the Phoenix housing market correction ending soon?

The Phoenix housing market correction is still unfolding. Some areas may stabilize sooner than others depending on demand and inventory levels.

Will Phoenix home prices drop significantly?

While further adjustments are possible, a dramatic collapse is not guaranteed. Most homeowners still retain substantial equity from previous appreciation.

Is Phoenix still a good place to invest in real estate?

Long-term fundamentals such as population growth and economic expansion continue to support real estate demand in Phoenix. Investors focused on sustainable returns may find opportunity during the Phoenix housing market correction.

Should I wait to buy during the Phoenix housing market correction?

Waiting for the exact bottom is nearly impossible. Buyers should focus on affordability, long-term goals, and current negotiation advantages.

Are sellers struggling in the Phoenix housing market correction?

Homes priced realistically and presented well are still selling. The key difference is that sellers must be strategic rather than aggressive.

Conclusion

The Phoenix housing market correction is not the end of opportunity — it’s the end of extremes. After an extraordinary surge, the market is adjusting to more balanced conditions. Buyers are regaining leverage. Sellers are recalibrating expectations. Investors are returning to fundamentals. Cycles are natural in real estate. For those who understand the shift and act strategically, the Phoenix housing market correction can be less of a threat and more of a turning point. In a city as dynamic and resilient as Phoenix, change does not signal decline — it signals evolution.